Who's got you covered?

- Captain Alexander

- May 11, 2022

- 4 min read

In the same way we take out insurance against medical, motor vehicle, household and other kinds of liabilities, aircraft owners and pilots alike need to have some sort of safety net to protect them from hard landings (pun intended) which they may encounter in their day to day operations.

For student pilots, there is a special "trainee pilots" insurance policy (more of a personal accident policy) that they purchase as they enroll in whichever Approved Training Organization (ATO) they opt for, to cover them for that year in which they are undergoing training.

There are different cover limits that the student can choose, and as you'd expect, higher cover limits and benefits selected by the individual attract higher premiums.

In order for the policy to be activated, there are a number of requirements that have to be satisfied on the part of the student. These include:

The student has to be enrolled in an approved training facility.

The student must have a valid KCAA medical certificate (2nd class certificate for SPL/PPL holders).

A valid SPL (Student's Pilot License- This can only be provided after one does their medicals).

A copy of the ID and KRA Pin

Duly filled proposal form which the school administration can help you to fill the required sections

Complete payment of premiums, based on the cover limit selected, to the insurance company enlisted by the school.

For commercial pilots, their respective companies could enroll them into a corporate/group scheme in which all members of staff are covered, with the limits of cover being decided upon by the Human resources department or whichever branch of administration that is tasked with this.

The criteria for approval of cover may differ slightly from the student one but the insurer will provide the necessary guidelines

In the course of training, more-so before their practical sessions, students are made aware of the fact that there are certain documents that should be on board the aircraft at all times before taking-off.

These include:

Airworthiness Certificate

Weight and Balance information

Certificate of registration

Aircraft radio license

... AND

A copy of the Insurance Certificate

This comes in the form of a hard copy policy document, unlike the stickers we use on our cars. The certificate should be in the aircraft at all times and the student or commercial pilot should ascertain that the cover is valid before embarking on a flight, so that this does not bring issues later on should a claim be lodged for whatever reason.

Most of the big insurance companies like Heritage, GA, Allianz, Jubilee, AIG etc have this cover in their portfolio, and so it is up to the aircraft owner to go source for affordable covers or appoint an agent to help them do so.

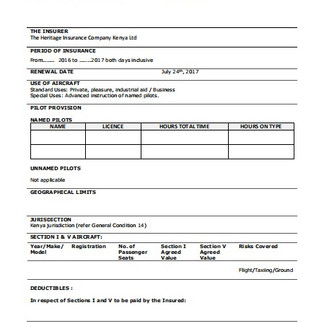

A typical aviation insurance proposal form is quite detailed as you shall see below. It is divided into sections in which the proposer has to fill details pertaining to the make of the aircraft, the year of manufacture, the value of the aircraft, geographic limits that the aircraft shall fly within, whether a financier has any interest in the aircraft, among other details.

Such information is useful to the insurer as they determine premium calculations based on the data provided. The insurer may also chose to decline the proposal if they anticipate any risk they are not willing to undertake.

The proposer (aircraft owner or company) can also select clauses, or in simpler terms, additional benefits to supplement the main aircraft cover.

Additions such as hail damage clause or unlicensed landing ground suitability clause are among the various benefits included in the policy, for which there are certain conditions that have to be met in the event a claim is made under any of these clauses. It is also good to note that these additions increase the total value of the payable premiums.

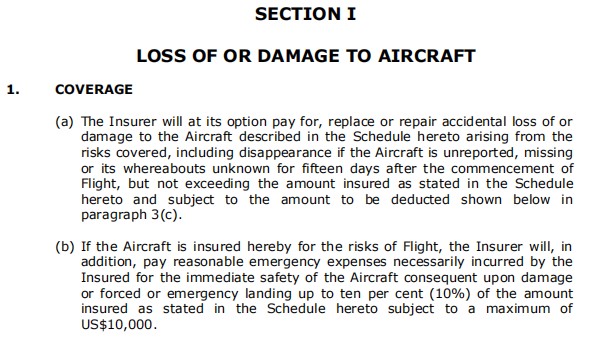

COVERAGE AND EXCLUSIONS

Because insurance policies are a kind of contract between the insurance company and the insured, the company will not compensate should a claim be brought forward or worse , the cover can be made null and void if the insured violates the terms laid out by the company.

Here is one example of a coverage and exclusion section in a typical aviation insurance policy.

Another exclusion example is the "geographical areas limitations".

What this means in simple terms is that the insurer will not offer compensation for loss or damage to the aircraft, where the said damages occur within specific countries or regions, eg:

Iran, Iraq, Libya, Yemen, Syria.

Georgia, Nargono-Karabakh, North Caucasian Federal District.

Colombia, Ecuador and Peru.

Algeria, Burundi, Cabinda, Central African Republic, Congo, Somalia, Liberia, Eritrea, Ethiopia, Mauritania.

Afghanistan, Jammu and Kashmir, Myanmar, North Korea, Pakistan.

Any country where the insured aircraft is in breach of UN Sanctions.

These fall under "high-risk" regions and therefore the insurer will do what is in their best interest to avoid taking up proposals for aircraft operating in such regions.

The only situations where the insurer may consider coverage in the above mentioned countries include:

- Landings as a result of force majeure (natural disasters, acts of war etc)

- Overflight via the countries listed, provided that the flight is performed within an internationally recognised air corridor and in accordance with ICAO recommendations.

The insurer may still also opt to provide coverage for the aircraft in these countries but at terms to be agreed upon by the insurer prior to flight.

Other coverage and exclusions exist but I cannot include them all here as they are quite lengthy.

With this, you now have some basic understanding of the workings of aviation insurance.

Commentaires